Image: Holiday, 1938

For those of us following developments in FinTech, the concept of “open banking” is often thrown out, but rarely unpacked. We think there are 2 primary reasons for that:

It sounds easy: for would-be pundits & bloggers, the term itself seems rhetorically intuitive. “Open banking” - two words that everyone gets, so just put them together. What’s so complicated about that?

It’s annoying to explain: it’s not rocket science, but it kind of requires multiple links of logic to explain. If you’re making a bigger point and just referring to open banking, trying to explain it would distract from the actual topic of the content

So, better to just keep it as kind of a hazy, nebulous concept, right? Wrong! Open banking is important, and we think it’s rollout will act as one of the major catalysts for innovation in financial services in MENA.

As people, and as businesses, we really need our banks. We need their cooperation to do just about anything, so our relationship, our interactions need to be harmonious. Our banks have a ton of information on us. By virtue of seeing how, when and where we spend money, they have the ability to have a full 360 degree lens on how we behave. It’s pretty obvious that more interconnectedness and smoother integration with our banks will make life easier for us, as people or as businesses.

When people refer to open banking, they’re referring to a process. A company approaches a bank and makes a business case that the bank should allow that company to directly integrate with it. Doing so would allow the bank’s customers to easily use the service that company is offering. Think about Careem suggesting that all ENBD customers can pay for rides directly from their bank account. By avoiding interchange fees, Careem could perhaps charge those customers 2% less. Great - it’s a win-win for those two groups, and a win for customers.

Now what has emerged are enterprising companies who pick up on this and say, “let’s go not just to ENBD, but to all banks within a particular region, get them to open up APIs with us, and then we will in turn offer these integrations not only to Careem, but to all sorts of other cool, new digital services.” If that falls into place, we start getting closer to a more seamlessly interconnected ecosystem. Voila: open banking.

It’s not a perfect analogy, but think about it like water. DEWA is the bank, and the house is the bank’s customer. The way it is now, one can only move water from the plant to the house. With open banking, the water can get directly to 6 sinks, plus a hose in the garden, plus a fire sprinkler system. Water is basically integrated all over the house in ways that make living in that house safer and more convenient. That’s what open banking does. For your life.

It’s actually brilliant. As Element Ventures’ Michael McFadgen posits: “Why, for example, should my banking and accounting happen in two different pieces of software when they are simply different representations of the same data? Or why should an SME need to call their bank for invoice financing when the same process could be automated inside their existing workflow?”

In other regions, open banking has rolled out like dominos:

1. Enterprising FinTech companies figured out how to back into integrations with banks, typically by reverse engineering the bank’s customer login process

2. Certain progressive banks adapted and allowed these integrations to continue with specific applications

3. Customers loved it

4. It became the new market expectation

5. All other banks were forced to adopt

6. The broader banking system became open

Earlier this year, Visa acquired open banking platform Plaid for $5.3bn.

In MENA, the conventional thinking has been that in order for regional banks to adopt open banking, there would need to be top-down directives by regulators in each country, requiring them to do so. Open banking could compromise some incumbent revenue streams for financial institutions, so banks wouldn’t sign up for it voluntarily.

To some extent, this was accurate. Bahrain was the first MENA government to introduce a regulatory framework advocating for open banking. The results were evident fairly quickly. For example, early adopting Bahraini banks were less hit by the challenges presented by the COVID-19 pandemic.

But we are also now seeing more multilateral adoption that is not necessarily government mandated. For example, the MENA FinTech Association recently launched the MENA Open Banking Vision, with the participation of self-mobilized, venture-backed open banking platforms, like one of our portfolio companies, DAPI.

We believe open banking will drive FinTech adoption in MENA in a major way over the next decade. Incumbent financial services institutions that “lean in” will stay relevant and potentially enhance market share. Those unwilling to tap into open banking will not stay afloat for long.

If you’re interested in this space here’s some more reading.

How is Open Banking Driving the Digital Revolution?

This series by strategy consultancy Kearney provides a good introductory overview of what open banking is, how it creates value, how the market players are responding to this trend, what the future will look like and its impact on SMEs.“The implications of this [open banking] decoupling for the financial services industry are huge, but the consequences are as of yet unknown. For some banks, the use of data by third parties will be a transformational opportunity, as new products and partnerships enable the creation of new and improved branded products. For others, it is a major threat, as third parties capture banking customers away from traditional players, particularly in crucial “last-mile” services, and turn some banks into mere ‘dumb pipes.”

How to Flourish in an Uncertain Future

This Deloitte UK report serves as an innovation guidebook for banks to adapt to the new open banking environment. In it Deloitte explains that in the ‘marketplace’ open banking model, customers can adopt a single banking interface to access products & services from a variety of different players, including incumbent banks, challengers and FinTechs. “This interface would both provide customers a holistic overview and use cognitive analytics to help them manage and optimise their finances.” Banks that are able to react with agility to today’s environment will be in a position to capture the ultimate prize: a deeper and more engaged relationship with their customer i.e. loyalty.

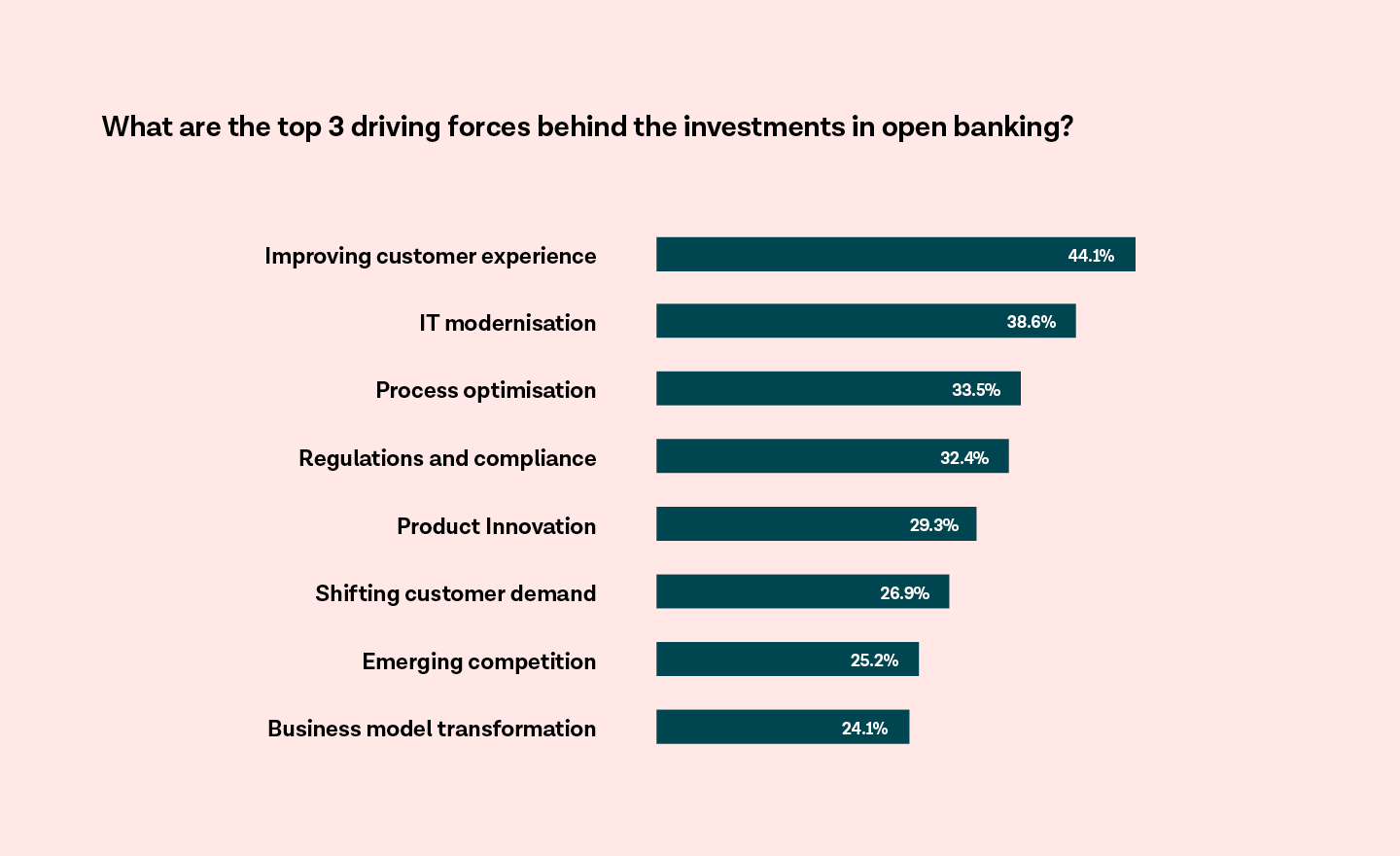

How European Banks Are Investing in Open Banking

Source: Tink article: ‘Why European banks are investing in open banking”, May 2020

Tink, a European financial API company, is driving open banking adoption on the continent. The company surveyed 290 senior executives and financial industry decision-makers to get their thoughts on what is driving, or hindering, open banking investments across Europe. “Lack of buy-in is typically one of the main challenges when it comes to technology investments, so this, paired with the positive shift in sentiment mentioned before shows senior executives in the industry see open banking as a very relevant opportunity.” Read on to find out more.

VentureSouq FinTech Portfolio Spotlight

Mumbai-based group payments platform for millennials goDutch recently raised $1.7M. This seed round was led by Matrix Partners India with participation from Y Combinator, Global Founders Capital, Soma Capital, VentureSouq and angel investors such as Justin Mateen (Co-founder, Tinder), Kevin Lin (Co-founder, Twitch) and Rohan Angrish (Head, ICICI Labs). The app enables users to record, split and settle group transactions such as rent payments, travel, shopping, dine out and home delivery. "Currently, for group payments people are using traditional payment apps which are designed for one to one payments. Given the frequency of shared transactions one has with their friends, it’s time to look at this problem separately. Thus, we are introducing the goDutch card through which friends can share their payments in real-time," said Riyaz Khan, co-founder, goDutch.

TUNE IN

In this Milken Institute Talk executives from seasoned FinTech mammoths Plaid, Setu, Finastra and Cross River were invited to discuss the acceleration of FinTech innovation. “In an effort to increase competition in financial services, governments around the world are implementing data access and portability regimes to make banking more inclusive, competitive, and transparent. What can the US learn from such ‘open banking’ efforts? In order to remain both innovative and internationally competitive, what type of data governance should American policymakers consider? What does this mean for banks, FinTechs, and Big Tech platforms?”