Solving the Middle East’s Grand Fintech Challenge: Payment Silos

Our take on payment silos in the regional trade landscape and ways to tackle them

Reviving Trade Legacy

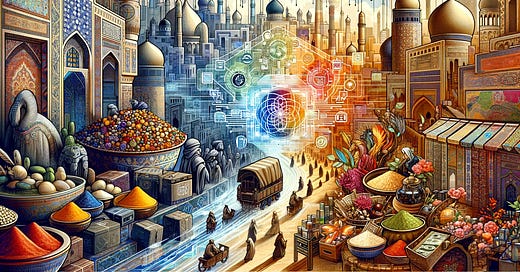

At the heart of ancient global trade, the Middle East once thrived as the central hub for major trade routes like the Silk Road and the Spice Route. These routes were more than mere channels for commodities; they were dynamic bazaars filled with diverse languages, exotic goods, and a rich marketplace of cultures, ideas and technologies. Exchanges at these bazaars were instrumental in shaping civilizations far beyond the Middle East, marking the region's profound influence on the global stage.

Now, the Middle East enters a window of opportunity to reclaim its role as the bridge between the East and West in an ever-divided world. However, a pivotal question stands: what is preventing the region from reviving its historic commercial dynamism?

The Modern Challenge: Payment Fragmentation

The ancient bazaars thrived on a seamless yet unseen infrastructure of currencies, rules, and trust. Today's trade, though run on digital rails, still hinges on these same crucial elements. What is not the same is the new kinds of challenges merchants face in the process of money exchange, the foundation of it all. It is as broken and as fragmented as ever. Complex payment flows, global payment risks, low conversions, failed transactions are only a few of payment issues that modern cross-border merchants have to unnecessarily deal with.

Knowing the nature of ancient trade routes, it is impossible to not recognize that today’s primary challenge is the fragmentation caused by payment silos. Different “stalls” are strewn across disparate areas of modern bazaars. Many countries in the MENA region and the adjacent markets form their own silos of trade relationships, rules, trust and payment systems. Each of them is unique and complex, adding unwanted work to want-to-be-successful merchants’ operations.

At Venturesouq FinTech, we recognize that bridging the financial rails of these disparate silos presents both a grand challenge and a golden opportunity for the region. By investing in new fintech custodians that can bridge these divides, we can revive our modern bazaars as thriving trade hubs.

New-Age Custodians of the Bazaar

To improve the cross-border trade experience for regional merchants, we need new-age financial infrastructure companies to become the silent custodians of the modern bazaar. With their tech solutions, they should create a new financial language, a new code of rules, and new corridors of trust. Venturesouq’s FinTech thesis sees three core elements in these emerging architects:

Hyperlocal with Global Capabilities: It's not enough to understand just one corner of the bazaar for it to work well. To enable efficient financial relationships and economic growth, the region needs infrastructure companies that think on a region-wide scale but act hyper-locally. The ultimate goal is to see a seamless transaction between, say, a merchant with a digital wallet in Pakistan and its counterparty with a bank account in North Africa, financed by a GCC lender and insured by a Jordanian institution;

Breaking Down Barriers: The trifecta of data, distribution, and access to capital is the holy grail that all fintechs need to solve. However, infrastructure companies that weave these elements into their fabric don't just enable trade; they power growth for every entity in the bazaar. Interoperability of data systems, a diverse set of options for distribution of products and seamless access to debt capital is the end-state we would like to see in these new payment infrastructure players;

Regulatory Harmonization: Navigating a maze of local laws is daunting, but it's non-avoidable. The most transformative FinTech infrastructure companies are those that grow to become fluent in the complex lexicons of multiple regulatory regimes, facilitating true cross-border relationships. It is important to note that the “divide and conquer” approach may not necessarily work. To build efficient financial rails at scale, companies need to juggle multiple high-priority geographies and their regulatory regimes at once.

Spotlighting a Custodian: MoneyHash

As we navigate the incredibly dynamic regional FinTech landscape, we're not just looking for the next 'big thing.' We are looking to invest in the architects of a new financial foundation, the custodians of modern bazaars. At Venturesouq FinTech Fund, we imagine a company that embodies the above principles so intrinsically that it turns into the backbone holding the bazaar together.

One such company is MoneyHash. It harmonizes and brings to life every single facet of our FinTech infrastructure thesis, actualizing the principles above and transforming regional trade. With 30% of digital payments failing in the region, navigating the fragmented and highly complex bazaar is very costly for local merchants. To tackle the issue, the great team at MoneyHash, led by Nader Abdelrazik, recently launched their payment operating system that offers a fully end-to-end infrastructure solution. It abstracts away the complexities of payment infrastructure, flows, and operations while also being tailored to the common use-cases in each of 40+ regional markets covered.

This suite of fully integrated products enables your business to integrate multiple payment processors and methods, optimize payments flows and recurring revenue, reduce fraud and payment failures, streamline reconciliation processes, and handle various payment needs efficiently. We believe that what Moneyhash is building is the first significant step to break down the financial complexities in regional trade for merchants of any size.

For those navigating the complexities of the regional payments ecosystem, we encourage you to explore a solution in Moneyhash 2.0 here. This could be a step towards not just gaining an unfair advantage for your business, but also contributing to the broader economic resurgence of the Middle East.