Image: James Bond, Diamonds Are Forever, 1971

While the percolation of FinTech into our everyday lives has been happening over decades, the rate of change has accelerated in the last few years, and seems to be reaching a literal fever pitch now.

This pandemic is serving to expedite the adoption of connected payment-enabled devices beyond the retail industry and to introduce new revenue streams across the technology ecosystem.

Next-generation FinTech companies are seamlessly integrating with Internet of Things (“IoT”) devices, fully automating payments via everything from computer screens to store shelves to vehicles to home appliances to utilities. Almost 70 years ago, Ian Fleming captivated the world with James Bonds’ clever gadgets and gizmos that could do jaw-dropping, life-saving wonders. Today we’re getting to the point where those same, seemingly basic tools, can conveniently charge us for everything we pick up, use, look at, or even think about (ah, the brilliance of technology!). While of course major gating issues like security and the velocity of behavioral adoption are far off from being “solved”, we expect to see more data analytics-driven startups providing secure infrastructure for automated payments in connected devices in the near future.

The Second Wave of FinTech Disruption

In this piece, Mike Laven, the CEO of Currencycloud, a remittances software company that recently raised $80m from Visa, the World Bank and others, puts forth three trends he believes will shape the future of payments, namely: consolidation, substitution & a more fundamental shift in value proposition. “We are standing on the cusp of FinTech’s second major wave of disruption – and this one is going to be the real game-changer. Products, processes and ways of working are designed for digital and, crucially, have payments technology embedded in the user experience from start to finish.”

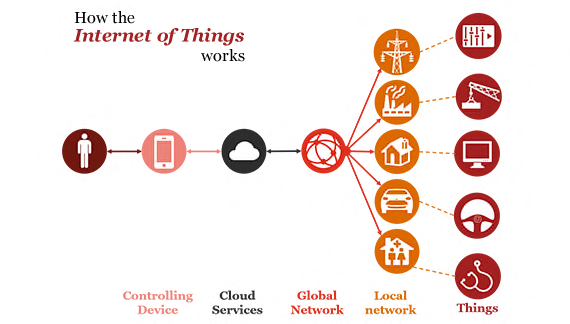

How IoT Changes Banks and FinTech Companies

Unsure how to approach the nexus of FinTech and IoT? This helpful write-up by LeewayHertz analyst Allen Adams enumerates eight trends in banking that help us understand the adoption of IoT in FinTech - by looking at specific applications. “The FinTech locations that are seeing the most changes [in IoT] include customer service, safety and security, repayments, internal procedures, and facilities.”

Image: PwC India

IoT: The Catalyst for Invisible Payments

This PwC piece sheds further light on how the IoT works and the ways in which it is transforming the way businesses, governments and consumers interact with the physical world. “The Internet of Payments space is an appealing prospect for not only software and hardware developers, but also for banks and other FinTech companies that can help drive innovation in the payment space through the use of NFC chips, payment apps, sensors, tracking devices, etc.”

VentureSouq FinTech Portfolio Spotlight

LatAm-focused Belvo has built a developer-first API platform that can be used to access and interpret end-user financial data to build better, more efficient and more inclusive financial products. The company recently raised $10M led by Silicon Valley’s Founders Fund and Argentina’s Kaszek. The company aims to work with leading FinTechs in Latin America including neobanks, credit providers and personal finance products.

With over 500 million users online, most merchants in India still rely on notebooks to log in their transactions. Bangalore-based OKCredit enables these small merchants to digitize their bookkeeping. Backed by the likes of Tiger Global and Lightspeed Venture Partners and in light of the nation’s recent lockdown, the company is adapting, eyeing the B2C segment by quietly launching a nearby store feature. You can read more about the company’s journey in this interview with OKCredit’s CEO Harsh Pokharna.

Abu Dhabi and San Francisco-based FinTech Dapi takes on the MENA region’s scattered open banking landscape. “The region is super scattered,” says Dapi Founder Mohammed Aziz. “Whilst Bahrain was the first in the Middle East to adopt open banking regulations, and Saudi Arabia is moving ‘more aggressively’ towards similar regulations within the next two years, Aziz says many other countries in the region are still a lot further off.”

TUNE IN

Insights: Transforming Financial Services Infrastructure Post COVID-19

In this Fintech Insider episode, Sarah Kocianski and her guests discuss the impact of the pandemic on FS organisations’ digital infrastructure and transformation push, forcing them to innovate quicker than they’ve ever done before.